Increase financial liquidity for SMEs.

Quick Approval , Convenient, Flexible.

Boost your SME growth exponentially.

How we help your business grow?

Siam Validus acts as an intermediary for SMEs to get funding by way of crowdfunding debentures via our platform. Investors can choose to invest in crowdfunding debentures from a variety of businesses.

SMEs business owners can access funding capital more easily as Siam Validus can help SMEs crowdfund. SMEs can use this capital to expand their business or to increase cash flow without having to use assets as collateral.

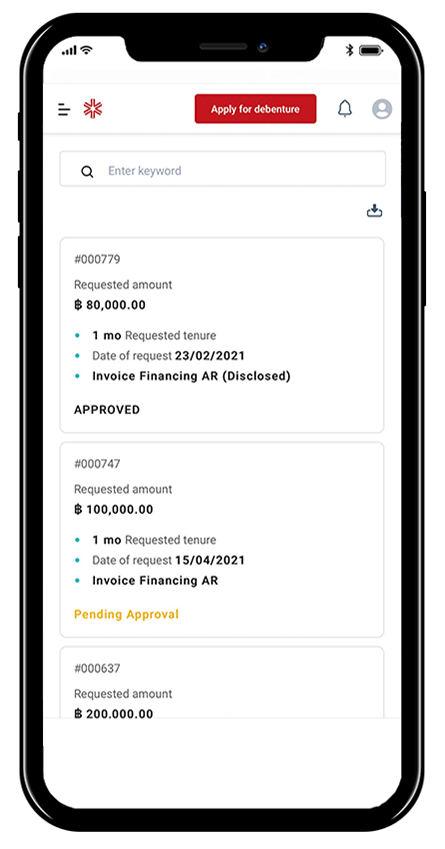

How to get funding

SMEs can get funding conveniently.

Register in just under 15 minutes.

Get an approval within 48 hours.

Start raising fund immediately.

Get paid within 3 business days after a successful fundraising.

Our Services

For suppliers and carriers

*Siam Validus account is currently available exclusively for SCG’s partners.

For dealers and distributors

*This service is currently available exclusively for SCG’s partners.

For all SMEs

- A one-time repayment – one to four months repayment period.

- A monthly repayment – 12 months repayment period.

Frequently Asked Questions

Who is able to issue crowdfunding debentures via Siam Validus’ platform?

Qualifications for bond issuer:

- Your business is registered in Thailand as a company limited or a public company limited

- Your business has at least one Thai shareholder (at least 20% shareholding), who is actively operating the business and residing in Thailand.

What are the steps to issue crowdfunding debentures?

There are 4 steps in issuing Crowdfunding Bonds

Step 1: Application and credit assessment

Company applies on Siam Validus platform

– Proposal to raise funds i.e., business expansion, working capital, debt consolidation

– Upload documents for credit assessment

After Siam Validus assesses the company for credit-worthiness based on their documents, Siam Validus assigns a credit grade that translates into an interest pricing for the debenture. Then the company must agree to proposed credit grade and terms to proceed with e-signature of documents.

Step 2: Subscribing to a Crowdfunding Bond

Once the Company agrees to credit grade and terms, Siam Validus will list the Crowdfunding Bond campaign on the platform.

Investors can review the Crowdfunding Bond details before investing. Crowdfunding Bonds are issued when it is successfully funded, if the subscription is not successful, investors will receive a refund of the subscription amount.

Step 3: Issuing Crowdfunding Bond Certificate

The company reviews Crowdfunding Bond subscriptions and assigns Rights and Duties of Issuer and Bondholders. At this time, funds are transferred from the custodian to the company, and bond certificates are issued to the investors by the company.

Step 4: Ongoing obligations by Bond Issuer

Siam Validus maintains the Bond Registry on behalf of the company (the Bond Issuer) and tracks repayments to Investors over the duration of the Crowdfunding Bonds.

What should I do when the crowdfunding debenture issuer delay the settlement date?

In case the issuer encounters a problem which may lead to a default. Please contact Siam Validus immediately for us to take care of, advise and find possible repayment options such as extension bond redemption period or change the payment date.

What documents will I need to prepare in order to get funding?

- Certificate of Incorporation

- List of all Shareholders

- Company’s primary bank statement

- Latest Audited Financial Statements

- Company’s Credit Reports from National Credit Bureau

- Main shareholder’s (>20% shares) copies of ID Cards (or Passports)

Through which channels can I pay back the loan?

Bank transfers or direct debit.

Is it possible to withdraw the crowdfunding debentures before the appointed period?

Yes, absolutely. If you wish to pay off your Crowdfunding Bond completely, please contact us and we can give you the settlement information.

Is it possible to change the settlement date?

The Debt Crowdfunding Prospectus will set out your repayment schedule. If you require any changes to that schedule, please contact us.

How much is the interest rate?

It can vary from 5-17% per annum depending on the SME profile, credit analysis, type of facility, amount and tenure.