Start Investing

Start Investing

Revolutionize Thai SMEs investment.

More inclusive and liberating than ever before.

Begin investing in competent Thai SMEs with ease using our innovative crowdfunding platform. Siam Validus’ AI-driven platform can evaluate and hand-pick businesses suitable for your investment, forecast average yearly returns and display a real-time dashboard summarizing your investment.

Reference: All Validus group market research as of 1st August 2021 (By internal research data of Validus group)

Risk Evaluation

Invest with confidence. Siam Validus offers the SV rating to our investors to use as a risk evaluation tool. We use the SV rating to determine the risk level of the SME fundraisers who plan to issue crowdfunding debentures. The evaluation criteria considers multiple aspects such as type of business, company budget and its business record. These pieces of information are always up to date so that they reflect the potential of debentures.

SV Score

Ranking of SMEs based on scoring criteria created using an algorithm that was tested and built using data from SMEs in the Siam Validas database at all times. which is handling requests for funding from people who want to operate a business. comprising commercial data and financial statements that are rated A+, A, B+, B, C+, and C, which can represent the business’s potential. stability in finances. Credit rating, however, is not a reliable indicator of one’s capacity for debt repayment. There will also be a procedure for calculating the ability to repay debt. Prior to authorizing the fundraising via the platform.

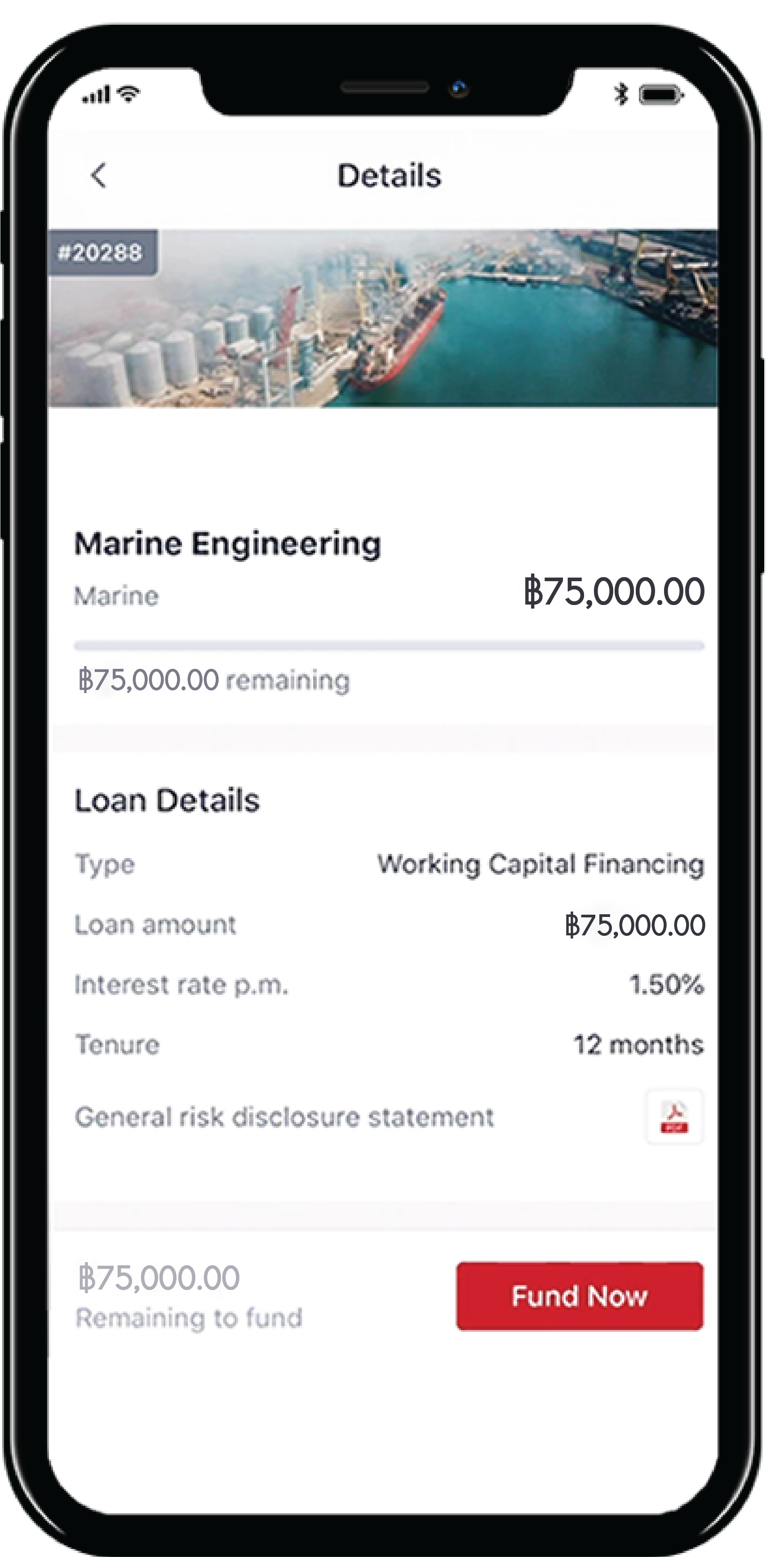

Become our investor easily, just by signing up via your smartphone.

Our sign up procedure requires only your phone number, email, ID card and your passbook or a screenshot of your bank application indicating your bank account number.

Every step is secured with Live Photo identification system. Signing up takes just 3 steps to complete!

How does our platform work

Build your portfolio

Register and fill out your information.

Assess your risk tolerance.

Upload required document.

Start investing in 24 hours.

An opportunity to grow your capital starts today.

How to find and invest in trustworthy SMEs

Check for the latest opportunities.

Choose the SMEs that interest you.

Learn more about their business and debentures.

Start investing!

Start investing in SMEs promptly and conveniently. Accessible from anywhere, 24/7.

Products on Our Platform

Frequently Asked Questions

What is the eligibility criteria to open an Investor Account?

Accredited investor

Definition and the proof of investor can be divided into 3 groups as follows:

- Group 1: Investors who have directly invested in the stock market for at least 1 year and have net asset of 50 million baht and above.

– The proof of net asset, excluding property for residence, mortgaged properties. - Group 2: Investors who have directly invested in the stock market for at least 1 year and have an annual income of 4 million baht and above.

– The proof of annual income (personal income tax, pay-slip, rental income, investment income). - Group 3: Investor with 3-year experience in business or investment related field and have 5 million baht and above invested directly in stocks.

– The proof of work experience and investment portfolio in stocks (recent month statement).

To register for an Investor account, please have the following documents ready:

- Scanned copy of ID card / passport

- Scanned copy of first page of bank account

- Proof of investor type (for accredited investor)

How does Siam Validus assess SMEs (Bond Issuer)?

The bond issuer will be assessed based on various factors – combination of financial product requested, NCB rating, business sector, financial statement, bank statement etc. This data will be put into the credit rating system of Siam Validus.

What are the businesses that can apply to issue Crowdfunding Bonds?

The business that is able to issue Crowdfunding bonds is a registered business in the form of a limited company or public company.

What's the minimum or maximum investment term?

Debenture tenors are for typically for a period between 30 to 180 days. Tenor varies according to facilities and SMEs involved.

What is the fee that I have to pay to Siam Validus?

We charge a fee on all incomes, interest, charges & penalties that are received by an investor through the platform.

This is payable to Siam Validus and will be deducted before the amount due to you in accordance with the transaction document is reflected on your dashboard.

What are the risks? (Risk Disclosures)

To help you understand the risks involved when investing in Crowdfunding Bonds on Siam Validus, please read the following risk summary.

- The need for diversification when you invest

Diversification involves spreading your money across different types of investments with different risks to reduce your overall risk. However, it will not lessen all types of risk.

Diversification is an essential part of investing. Investors should only invest a proportion of their available investment funds via Siam Validus and should balance this with safer, more liquid investments.

- Risks when investing in Crowdfunding Bonds

With Crowdfunding Bonds, you receive regular payments from the issuing company (the “Issuer”) until maturity. Before investing, you must read and agree to the prospectus for each Crowdfunding Bond as these contain the exact terms and conditions, including repayment time between investors and the Issuer.

It is important to understand that Crowdfunding Bond Issuers are solely responsible for their financial status and consequently their ability to make repayment. Siam Validus does not issue the Crowdfunding Bonds listed on the Siam Validus platform and is not responsible for their performance.

Crowdfunding Bonds represent a high degree of risk and you should be aware of the specific risks involved in investing in them.

- Loss of investment and interest payments

Crowdfunding Bond Issuers, like all businesses, are vulnerable to financial difficulty and investing in Crowdfunding Bonds may involve significant risk of default. In the event of an Issuer being unable or unwilling to meet payments, it is likely that you may lose all, or part, of your initial investment and receive no outstanding or future interest payments.

If a business you invest in fails, neither the company you invest in nor Siam Validus will pay you back your investment. You should only invest an amount that you are willing to lose and should build a diversified portfolio to spread risk.

Crowdfunding Bonds are not insured by a third party nor are they protected by any governmental authority. This means that if the Issuer becomes insolvent, investors could lose some or all of their money.

- Lack of liquidity

Liquidity is the ease with which you can sell your investments to a third party after you have purchased them. Investments in Crowdfunding Bonds through Siam Validus should be viewed as an illiquid investment.

- Unsecured investment

Unless otherwise set out in the prospectus, Crowdfunding Bonds are typically an unsecured obligation of the Issuer, meaning there is no security over the property or assets of the Issuer supporting the repayment of your investment. This means that if an Issuer fails, it is unlikely that an investor will have their initial investment or outstanding interest payments returned to them because there is no security over any remaining Assets.

- Early call risk

The Issuer has the right to repay you your money at any time prior to the formal repayment date. Your investment may be materially curtailed because of this.

- Liquidation event

If a Debt Crowdfunding Issuer falls into financial difficulty and goes out of business, other creditors and debt holders with seniority – including administrators, employees who are owed wages, banks, and secured debtors – will be compensated first. This means it is unlikely Debt Crowdfunding investors will have their initial investment or outstanding interest payments returned to them after higher ranked creditors are compensated.

- Interest rate and inflation risks

Crowdfunding Bonds pay interest at a fixed rate rather than by reference to an underlying index. Accordingly you should note that a rise in interest rates may adversely affect the relative returns that Crowdfunding Bonds offer. Further, inflation may reduce the real value of the returns over time.

Siam Validus is a partnership between SCG Distribution and Validus, one of the leading Fintech companies in South East Asia.

Siam Validus is a part of the Validus group, one of the leading Fintech companies in South East Asia. Our company have established a partnership with SCG distribution, which is among the top distribution businesses in Thailand and South East Asia.

We are one of the largest crowdfunding platforms for SMEs in the region. Our mission is to minimize the SMEs financing gap in South East Asia, utilizing data analytics, machine learning and AI to fund SMEs.

Siam Validus is a crowdfunding platform for Thai SMEs. We are the first international company is licensed by the Securities and Exchange Commission (SEC) to offer crowdfunding services in Thailand. via crowdfunding debentures for national SMEs. We have also partnered up with several top companies to help us reach a broader group of SMEs.

Siam Validus is backed by venture capital and established partners.