สนใจลงทุน

สนใจลงทุน

ที่มีศักยภาพในการเติบโตสูง

พลิกโฉมการลงทุนใน SMEs ไทย

เปิดกว้างและอิสระแบบที่ไม่เคยเป็นมาก่อน

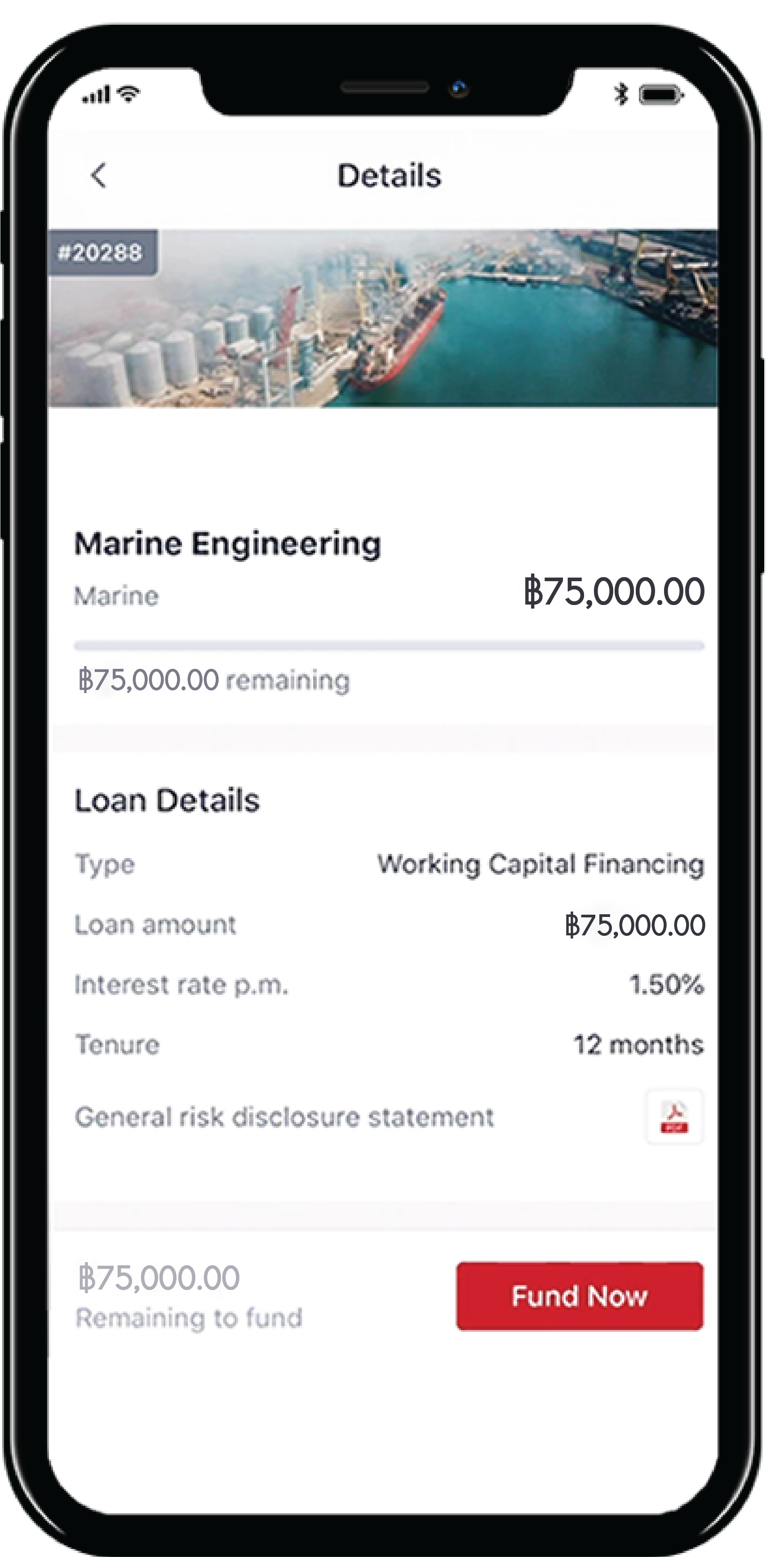

ก้าวเข้าสู่การลงทุนใน SMEs ศักยภาพสูงของไทยได้อย่างง่ายๆ ด้วยแพลตฟอร์มคราวด์ฟันดิงจากสยาม วาลิดัส ที่มีระบบ AI ช่วยคัดเลือกธุรกิจที่ตรงกับความต้องการ พร้อมคาดการณ์ผลตอบแทนเฉลี่ยต่อปี และมี Dashboard สรุปผลการลงทุนแบบ Real-time สามารถดูได้ทุกที่ ทุกเวลา

แหล่งข้อมูล : บทวิเคราะห์ตลาดโดยรวมของทั้งกลุ่ม Validus (โดยข้อมูลภายในของ Validus Group) ณ วันที่ 1 ส.ค. 64

กลุ่มของบริษัทที่มาระดมทุนบนสยาม วาลิดัสแพลตฟอร์ม

แบ่งออกเป็น 3 กลุ่มดังนี้

การประเมินความเสี่ยงการลงทุน

สยาม วาลิดัส จัดทำ SV Score เพื่อให้นักลงทุนใช้ประเมินความเสี่ยงการลงทุนได้ด้วยตัวเอง โดย SV Score เป็นการประเมินระดับความเสี่ยงของบริษัทผู้ขอระดมทุน (SMEs) ที่ต้องการออกหุ้นกู้ โดยพิจารณาจากหลายปัจจัย เช่น ประเภทธุรกิจ, งบการเงิน, ประวัติทางการค้า เป็นต้นโดยมีการอัพเดตจากข้อมูลจริงเพื่อให้สะท้อนถึงศักยภาพของหุ้นกู้ ณ ปัจจุบัน

SV Score

การจัดลำดับคะแนนของบริษัท SMEs ตาม scoring criteria ที่จัดทำด้วย อัลกอริทึม (Algorithm) ที่ได้รับการพัฒนาและทดลองกับข้อมูลของ SMEs ที่อยู่ในฐานข้อมูลของสยามวาลิดัสตลอดเวลา ซึ่งเป็นการประมวลผลทั้งผู้ขอระดมทุนที่ดำเนินธุรกิจ รวมถึงงบการเงินและข้อมูลการค้าประกอบกัน โดยแบ่ง rating ออกเป็น A+ / A / B+ / B / C+ / C ซึ่งสามารถบ่งบอกถึงศักยภาพของธุรกิจ ความแข็งแรงด้านการเงิน อย่างไรก็ตาม Credit rating ไม่ได้บ่งบอกถึงความสามารถชำระหนี้แต่อย่างใด ซึ่งการคำนวณในเรื่องความสามารถในการชำระหนี้จะเป็นอีกกระบวนการหนึ่ง ก่อนที่จะอนุมัติขึ้นระดมทุนผ่านแพลตฟอร์ม

สมัครเป็นนักลงทุนได้ง่ายๆ

ผ่านโทรศัพท์มือถือ

เพียงใช้เบอร์โทรศัพท์ อีเมล บัตรประชาชน และสมุดบัญชีเงินฝากธนาคาร หรือภาพหน้าจอบนแอปพลิเคชั่นของธนาคารที่มีเลขบัญชีของคุณ

ปลอดภัยทุกขั้นตอนด้วยการยืนยันตัวตนแบบ Live Photo พร้อมสมัครง่ายใน 3 ขั้นตอน

แพลตฟอร์มของเราทำงานอย่างไร

สร้างพอร์ตการลงทุนของคุณ

ลงทะเบียนและกรอกข้อมูล

ทดสอบระดับความเสี่ยงที่ยอมรับได้

อัปโหลดเอกสารประกอบการสมัคร

เริ่มลงทุนได้ภายใน 24 ชั่วโมง

โอกาสในการสร้างผลตอบแทนที่มากกว่า เริ่มแล้ววันนี้

วิธีค้นหาและลงทุนใน SMEs ที่น่าเชื่อถือ

ดูโอกาสการลงทุนที่อัปเดตใหม่

เลือกธุรกิจ SMEs ที่คุณสนใจ

ศึกษารายละเอียดเกี่ยวกับกิจการและหุ้นกู้

ลงทุนในกิจการได้เลย!

ลงทุนใน SMEs ได้อย่างเร็ว ง่ายและเข้าถึงได้ทุกที่ทุกเวลา

ผลิตภัณฑ์บนแพลตฟอร์มของเรา

คำถามที่พบบ่อย

ความรู้ทั่วไปเกี่ยวกับ คราวด์ฟันดิง

สยามวาลิดัส เป็นใคร

บริษัท สยาม วาลิดัส แคปปิตอล จำกัด (สยามวาลิดัส) เป็นผู้ให้บริการแพลตฟอร์มคราวด์ฟันดิง ที่ได้รับความเห็นชอบจากสำนักงานคณะกรรมการกำกับหลักทรัพย์และตลาดหลักทรัพย์ (ก.ล.ต.) ในการให้บริการระบบคราวด์ฟันดิง สำหรับระดมทุนในรูปแบบหุ้นกู้คราวด์ฟันดิง เพื่อธุรกิจเอสเอ็มอี (SMEs) ในประเทศไทย

สยามวาลิดัส เป็นบริษัทในกลุ่มวาลิดัส ซึ่งเป็นบริษัทฟินเทคชั้นนำในภูมิภาคอาเซียน และเป็นพันธมิตรกับ บริษัท เอสซีจี ดิสทริบิวชั่น จำกัด มีพันธกิจในการสนับสนุนการเติบโตอย่างยั่งยืนของ SMEs ในประเทศไทย ให้สามารถเข้าถึงแหล่งเงินทุน ผ่านการระดมทุนแบบหุ้นกู้คราวด์ฟันดิง เพื่อเสริมสภาพคล่องและรองรับการเติบโตของธุรกิจ

ทำไมต้องลงทุนในแพลตฟอร์มของสยามวาลิดัส

แพลตฟอร์มสยามวาลิดัส เป็นแพลตฟอร์มคราวด์ฟันดิงที่มีผลิตภัณฑ์การลงทุนทางเลือกให้กับนักลงทุน โดยที่

1. หุ้นกู้คราวด์ฟันดิงจะมีผลตอบแทนกำหนดชัดเจน ไม่ผันผวนตามตลาดหุ้น เพิ่มทางเลือกการลงทุนและกระจายความเสี่ยงจากการลงทุน

2. เลือกระยะเวลารับผลตอบแทนได้ตามต้องการ ลงทุนระยะสั้น 1-6 เดือน หรือ ระยะยาวสูงสุด 12 เดือนคำเตือนเกี่ยวกับความเสี่ยง: การลงทุนในหุ้นกู้คราวด์ฟันดิงเป็นการลงทุนที่ผู้ลงทุนต้องรับความเสี่ยงเองโดยตรง ผู้ลงทุนจึงต้องทำความเข้าใจในความเสี่ยงที่เกี่ยวข้อง ซึ่งหมายรวมถึงความเสี่ยงด้านสภาพคล่องของหุ้นกู้คราวด์ฟันดิง และความเสี่ยงในการสูญเสียเงินต้นจากการลงทุน หุ้นกู้คราวด์ฟันดิงเป็นการลงทุนที่ไม่ได้รับประกันความเสี่ยงและอาจมีสภาพคล่องน้อยเนื่องจากช่องทางในการเปลี่ยนมืออาจมีจำกัด ซึ่งผู้ลงทุนอาจจะสูญเสียเงินลงทุนบางส่วนหรือทั้งหมด ดังนั้น ผู้ลงทุนจึงจำเป็นต้องศึกษาข้อมูลและรายละเอียดเกี่ยวกับผู้ออกหุ้นกู้คราวด์ฟันดิงจนเข้าใจ โดยเฉพาะข้อมูลเกี่ยวกับความเสี่ยงให้ชัดเจน ก่อนตัดสินใจลงทุนทุกครั้ง บริษัท สยาม วาลิดัส แคปปิตอล จำกัด เป็นเพียงแพลตฟอร์มผู้ให้บริการระบบคราวด์ฟันดิงในการอำนวยความสะดวกช่องทางการลงทุนและข้อมูลต่างๆ เพื่อประกอบการพิจารณาลงทุนของท่าน และบริษัทฯ ไม่อยู่ในฐานะผู้แนะนำการลงทุนใดๆ บนแพลตฟอร์มได้

หากมีข้อสงสัยหรือต้องการข้อมูลเพิ่มเติมสามารถติดต่อได้ที่ สยามวาลิดัส Call center 02-026 6547 หรือ IR@siamvalidus.co.th

หุ้นกู้คราวด์ฟันดิง คืออะไร?

การระดมทุนในรูปแบบหุ้นกู้ Crowdfunding เป็นการระดมทุนในรูปแบบหนึ่ง ซึ่งมีตราสารหนี้เป็นประเภทหุ้นกู้ การลงทุนประเภทนี้เปิดโอกาสให้นักลงทุนที่สนใจการลงทุนทางเลือกเพื่อผลตอบแทนที่มากกว่าตลาดทุนหรือเงินฝากทั่วไป ผ่านช่องทางการลงทุนของผู้ให้บริการแพลตฟอร์มคราวด์ฟันดิง เช่น แพลตฟอร์มของสยามวาลิดัส

โดยผู้ออกหุ้นกู้คราวด์ฟันดิงบนแพลตฟอร์มของสยามวาลิดัส จะเป็นกลุ่ม SMEs ที่ระดททุนในนามบริษัทจำกัด มีจุดประสงค์เพื่อนำเงินมาเป็นเงินทุนหมุนเวียนในธุรกิจ ซึ่งรายละเอียดการขอระดมทุนจะระบุไว้ในเอกสารข้อมูลเกี่ยวกับหุ้นกู้ (Debenture Fact Sheet)

หุ้นกู้คราวด์ฟันดิงแตกต่างจากหุ้นกู้ในตลาดอย่างไร

หุ้นกู้ Crowdfunding แตกต่างจากหุ้นกู้ทั่วไปอย่างไร? ท่านสามารถอ่านได้ที่ บทความ

คำเตือนด้านความเสี่ยง

การลงทุนในหุ้นกู้คราวด์ฟันดิงเป็นการลงทุนที่ผู้ลงทุนต้องรับความเสี่ยงเองโดยตรง ผู้ลงทุนจึงต้องทำความเข้าใจความเสี่ยงที่เกี่ยวข้อง ซึ่งหมายรวมถึง (ก) ความเสี่ยงด้านสภาพคล่องของหุ้นกู้คราวด์ฟันดิง และ (ข) ความเสี่ยงในการสูญเสียเงินต้นจากการลงทุน เนื่องจาก หุ้นกู้คราวด์ฟันดิงเป็นการลงทุนที่ไม่ได้รับประกันความเสี่ยงและอาจมีสภาพคล่องน้อยเนื่องจากช่องทางในการเปลี่ยนมืออาจมีจำกัด ซึ่งผู้ลงทุนอาจจะสูญเสียเงินลงทุนบางส่วนหรือทั้งหมด ดังนั้น ผู้ลงทุนจึงจำเป็นต้องศึกษาข้อมูลและรายละเอียดเกี่ยวกับหุ้นกู้คราวด์ฟันดิงที่ตนจะจองซื้อ โดยเฉพาะข้อมูลเกี่ยวกับความเสี่ยงให้ชัดเจน ก่อนตัดสินใจลงทุนทุกครั้ง

ช่องทางการติดต่อสื่อสารกับสยามวาลิดัส (สำหรับนักลงทุนที่ลงทะเบียนและพร้อมลงทุนกับทาง SV)

ช่องทางในการติดต่อสยามวาลิดัส สามารถติดต่อได้ทาง

SV Call Center 02-026 6574

LINE Official (@siamvalidus)

สำหรับผู้ระดมทุน SME@siamvalidus.co.th,

สำหรับนักลงทุน IR@siamvalidus.co.th,

สำหรับการติดต่อทั่วไป info@siamvalidus.co.th

เรื่องควรรู้ก่อนการลงทุน

ประเภทนักลงทุนที่สามารถลงทุนบนแพลตฟอร์มคราวด์ฟันดิง

ประเภทของนักลงทุนที่สามารถลงทุนในแพลตฟอร์มคราวด์ฟันดิงได้

1. นักลงทุนสถาบัน (Instituation Investor)

2. นักลงทุนรายย่อย (Retail Investor)

3. นักลงทุนรายใหญ (High Net Worth)

4. นักลงทุนรายใหญ่พิเศษ (Ultra High Net Worth)

กลุ่มของบริษัทที่มาระดมทุนบนสยามวาลิดัสแพลตฟอร์ม แบ่งออกเป็นกี่กลุ่ม

กลุ่มของบริษัทที่มาระดมทุนบนสยามวาลิดัสแพลตฟอร์ม แบ่งออกเป็น 3 กลุ่มดังนี้

กลุ่มที่ 1 คู่ค้าของ SCG และบริษัทในเครือ SCG

สยามวาลิดัสได้รับข้อมูลทางการค้าซึ่งหมายรวมถึงข้อมูลการซื้อ-ขายและอื่นๆของบริษัทที่ระดมทุน เพื่อประกอบการจัดทำ สยามวาลิดัส rating การพิจารณาเป็นไปตามมาตรฐานการพิจารณาสินเชื่อของสยามวาลิดัส และเพื่ออนุมัติให้ระดมทุนบนแพลตฟอร์ม – ผู้ขายสินค้า/บริการ (Vendor / Supplier / Carrier) ให้แก่ SCG และบริษัทในเครือ SCG – กลุ่มผู้ซื้อที่เป็นคู่ค้าที่ทาง SCG แต่งตั้งให้เป็นตัวแทนจำหน่าย เช่น กลุ่มตัวแทนจำหน่ายสินค้าของ SCG (SCG Distributor/Dealer), กลุ่มผู้ซื้อทั่วไปเพื่อนำไปผลิตหรือจำหน่ายต่อ (Buyer)

กลุ่มที่ 2 คู่ค้าของพาร์ทเนอร์ของสยามวาลิดัส

สยามวาลิดัสได้รับความร่วมมือจากพาร์ทเนอร์ของสยามวาลิดัสในการได้รับข้อมูลการค้าซึ่งอาจจะได้ทั้งหมดหรือบางส่วน เพื่อใข้ประกอบการจัดทำ สยามวาลิดัส rating ผู้ซื้อสินค้าจากกลุ่มตัวแทนจำหน่ายสินค้าของ SCG เพื่อนำไปขายต่อซึ่งได้แก่ กลุ่ม Sub-dealer ผู้ซื้อสินค้าจากพาร์ทเนอร์ของสยามวาลิดัส ซึ่งมีข้อมูลทางการค้าเพื่อใช้ประกอบการทำ สยามวาลิดัส rating

กลุ่มที่ 3 กลุ่ม SMEs ทั่วไป

สยามวาลิดัสจะพิจารณาข้อมูลรายได้จากเอกสารการเสียภาษีของนิติบุคคลและเอกสารประกอบอื่น ตามมาตรฐานการพิจารณาสินเชื่อของสยามวาลิดัส เพื่ออนุมัติในการระดมทุนบนแพลตฟอร์ม กลุ่มผู้ประกอบการ SMEs ทั่วไป

เพราะอะไรจึงต้องทำแบบทดสอบความเข้าใจเกี่ยวกับการลงทุน (Knowledge Test)

เพื่อให้เป็นไปตามเกณฑ์การลงทุนของนักลงทุนประเภทรายย่อย (Retail Investor) ที่กำหนดให้นักลงทุนต้องทำความเข้าใจอย่างถ่องแท้ถึงความรู้และความเสี่ยงในการลงทุนผ่านแพลตฟอร์มคราวด์ฟันดิงก่อนการลงทุน

อีกทั้ง การลงทุนในหุ้นกู้คราวด์ฟันดิงเป็นการลงทุนที่ผู้ลงทุนต้องรับความเสี่ยงเองโดยตรง ผู้ลงทุนจึงต้องทำความเข้าใจในความเสี่ยงที่เกี่ยวข้อง ซึ่งหมายรวมถึงความเสี่ยงด้านสภาพคล่องของหุ้นกู้คราวด์ฟันดิง และความเสี่ยงในการสูญเสียเงินต้นจากการลงทุน เนื่องจาก หุ้นกู้คราวด์ฟันดิงเป็นการลงทุนที่ไม่ได้รับประกันความเสี่ยง ซึ่งผู้ลงทุนอาจจะสูญเสียเงินลงทุนบางส่วนหรือทั้งหมด ดังนั้น ผู้ลงทุนจึงจำเป็นต้องศึกษาข้อมูลและรายละเอียดเกี่ยวกับผู้ออกหุ้นกู้คราวด์ฟันดิงจนเข้าใจ โดยเฉพาะข้อมูลเกี่ยวกับความเสี่ยงให้ชัดเจน ก่อนตัดสินใจลงทุนทุกครั้ง

ผลิตภัณฑ์หุ้นกู้ที่เสนอระดมทุนบนแพลตฟอร์มของสยามวาลิดัส

ผลิตภัณฑ์การลงทุน มี 3 ประเภท

สินเชื่อเงินทุนหมุนเวียนอ้างอิงใบแจ้งหนี้สำหรับผู้จำหน่ายสินค้าและบริการ:Invoice Financing (Disclosed)- CVF

– ระยะเวลาชำระเงินคืน สูงสุด 4 เดือน

– ประเภทการชำระคืน แบ่งเป็น ชำระคืนแบบครั้งเดียว (Bullet payment) และมีโอกาสในการชำระแบบบางส่วน (partial repayment)

* บัญชีสยามวาลิดัส ปัจจุบันให้บริการเฉพาะคู่ค้าของเอสซีจีสินเชื่อเงินทุนหมุนเวียนอ้างอิงใบแจ้งหนี้สำหรับตัวแทนจำหน่ายหรือผู้ซื้อสินค้าและบริการ: Distributor/Buyer Financing – CDF

– ระยะเวลาชำระเงินคืน สูงสุด 4 เดือน

– ประเภทการชำระคืน แบ่งเป็น ชำระคืนแบบครั้งเดียว (Bullet payment)ผลิตภัณฑ์และอัตราดอกเบี้ย สินเชื่อวงเงินหมุนเวียนทั่วไป Working Capital Loan – WC

– ระยะเวลาชำระเงินคืน 6 หรือ 12 เดือน

– ประเภทการชำระคืน แบ่งเป็น ชำระคืนแบบครั้งเดียว (Bullet payment) ชำระคืนแบบ ลดต้น ลดดอก (Installment payment) และชำระคืนแบบชำระดอกเบี้ยและเงินต้นและดอกเบี้ยในงวดสุดท้าย (Interest Only payment)

ความเสี่ยงของผู้เสนอขายหุ้นกู้คราวด์ฟันดิงในการประกอบธุรกิจ

ผู้ออกหุ้นกู้คราวด์ฟันดิง คือ กลุ่ม SMEs ที่มีศักยภาพในการเติบโต และต้องการระดมทุนระยะสั้นเพื่อใช้ในการหมุนเวียนธุรกิจ หากเปรียบกับธุรกิจขนาดใหญ่ที่ระดมทุนในรูปแบบหุ้นกู้ อาจจะมีวัตถุประสงค์ในการกู้แตกต่างกัน ความเสี่ยงที่จะประกอบธุรกิจไม่สำเร็จจะสะท้อนตามศักยภาพธุรกิจของ SMEs และจุดประสงค์ในการเปิดระดมทุนคือใช้ในการหมุนเวียน จึงไม่ได้บ่งบอกว่าผู้ออกหุ้นกู้จะประสบความสำเร็จในการประกอบธุรกิจ

การซื้อขายเปลี่ยนมือสำหรับหุ้นกู้คราวด์ฟันดิง

หุ้นกู้คราวด์ฟันดิงเป็นหลักทรัพย์ที่สามารถซื้อขายและเปลี่ยนมือได้ แต่อย่างไรก็ตามเนื่องจากหุ้นกู้คราวด์ฟันดิงมีลักษณะเป็นหลักทรัพย์ที่มีสภาพคล่องต่ำ คือ อาจมีจำนวนผู้สนใจที่ต้องการซื้อหรือขายหุ้นกู้คราวด์ฟันดิงจำนวนจำกัด ซึ่งอาจส่งผลให้การซื้อขายหุ้นกู้คราวด์ฟันดิงไม่เป็นไปตามที่ผู้ลงทุนต้องการในบางช่วงเวลา อีกทั้งปัจจุบันยังไม่มีหน่วยงานเข้ามารองรับในการรับซื้อหุ้นกู้คราวด์ฟันดิง เพราะฉะนั้น การลงทุนในหลักทรัพย์ที่มีสภาพคล่องต่ำอาจมีความเสี่ยงที่สูงขึ้นเมื่อต้องการที่จะขายหลักทรัพย์ในช่วงเวลาที่ไม่เหมาะสมหรือต้องขายในราคาที่ต่ำกว่าราคาซื้อเนื่องจากความต้องการรับซื้อที่น้อยลง ทั้งนี้ การเปลี่ยนมือเป็นไปตามข้อกำหนดสิทธิสำหรับการออกเสนอขายหุ้นกู้ ดังนั้น ควรพิจารณาความเสี่ยงและรับรู้ว่าสภาพคล่องของตลาดหุ้นกู้คราวด์ฟันดิงอาจมีความผันผวนและเปลี่ยนแปลงได้ และควรศึกษาข้อมูลรวมไปถึงอ่านเอกสารรายละเอียดหุ้นกู้คราวด์ฟันดิง (Debenture Fact Sheet) ให้ละเอียด และวิเคราะห์ก่อนที่จะตัดสินใจลงทุนทุกครั้ง

เพราะอะไรฉันถึงไม่สามารถเปิดบัญชีนักลงทุนได้

การพิจารณาอนุมัติให้นักลงทุนสามารถลงทุนผ่านแพลตฟอร์มสยามวาลิดัสได้ ประกอบด้วย 2 ส่วน คือ

1. การยืนยันตัวตน หรือ Know Your Customer process (KYC) ปัญหาที่ทำให้กระบวนการอนุมัติการใช้งานล่าช้า คือ

– ส่งมอบเอกสารประกอบการสมัครไม่สมบูรณ์ คือ Live photo ซึ่งเป็นการถ่ายรูปเซลฟีคู่กับบัตรประชาชนและต้องมีพื้นหลังที่เป็นกระดาษรองระบุวันที่ถ่ายรูปชัดเจน

– เอกสารบัตรประชาชนหมดอายุ

– สำเนา Bookbank หรือ หน้า Mobile Banking ไม่ได้แสดงเลขที่บัญชีเต็มจำนวน2. AI Declaration มีข้อมูลคุณสมบัตินักลงทุนไม่ครบถ้วน กรณีที่ท่านสมัครเป็นนักลงทุนที่นอกเหนือจาก Retail Investor จะต้องยืนยันและให้ข้อมูลในการยืนยันคุณสมบัตินักลงทุนผ่านแพลตฟอร์ม

ทั้งนี้ท่านสามารถตรวจสอบสถานะการสมัครของท่านได้ ผ่านช่องทางในการติดต่อสยามวาลิดัส

สยามวาลิดัส Call Center 02-026 6574

หรืออีเมล

สำหรับผู้ระดมทุน SME@siamvalidus.co.th

สำหรับนักลงทุน IR@siamvalidus.co.th

ข้อมูลที่ควรศึกษาก่อนการลงทุน

Debenture factsheet คืออะไร

เอกสารแสดงรายละเอียดของผู้ระดมทุน เพื่อให้นักลงทุนสามารถพิจารณารายละเอียดของหุ้นกู้คราวด์ฟันดิงและรายละเอียดของธุรกิจของผู้ระดมทุน ซึ่งจะประกอบด้วย

1. วันที่เริ่มเสนอขายหุ้นกู้คราวด์ฟันดิง: Opening Date for the offer

2. วันที่ปิดการเสนอขายหุ้นกู้คราวด์ฟันดิง: Closing Date for the offer

3. ประเภทหุ้นกู้คราวด์ฟันดิง: Type of Debenture

4. วัตถุประสงค์ของการออกหุ้นกู้คราวด์ฟันดิง: Purpose for debenture

5. มูลค่ารวมของหุ้นกู้คราวด์ฟันดิงที่เสนอขาย: Requested Amount (Offer Size)

6. มูลค่าที่ตราไว้ของหุ้นกู้คราวด์ฟันดิง: Face value

7. สัดส่วนการจองซื้อที่จะถือว่าเป็นการเสนอขายที่สำเร็จ: Investment Threshold

8. ระยะเวลาการลงทุน (วันที่ไถ่ถอนหุ้นกู้): Expected Tenor of Investment (Maturity Date)

9. อัตราดอกเบี้ย: Interest Rate

10. คะแนนเครดิต*: สยามวาลิดัส Rating

11. ค่าธรรมเนียมการบริหารจัดการ: Administration Fees ที่นักลงทุนจะชำระให้กับสยามวาลิดัส

12. ตารางอัตราดอกเบี้ยรายผลิตภัณฑ์: Interest rate table by product

13. ข้อมูลอื่นของบริษัทผู้ออกหุ้นกู้: Other Information on SMEs

14. ความเสี่ยงเกี่ยวกับบริษัท: Business Risk

15. เอกสารประกอบ / Relevant Documents:

a. <หนังสือรับรองบริษัท (Company Certificate)>

b. <งบการเงินของบริษัท (Financial statements of SMEs)>

c. <งบแสดงฐานะทางการเงิน (Company’s Balance Sheet)>

d. <งบการเงินล่าสุดฉบับผู้สอบบัญชีรับรอง (Audited Financial statement of SMEs>

16. หุ้นกู้คราวด์ฟันดิงที่ดำเนินการอยู่: Open Facilities

17. ตารางการชำระคืน: Repayment Schedule

การสอบทานข้อมูลการเสนอขายและลักษณะการเสนอขายของหุ้นกู้คราวด์ฟันดิง

การสอบทานข้อมูลการเสนอขายและลักษณะการเสนอขายหุ้นกู้คราวด์ฟันดิงที่ดำเนินการโดยแพลตฟอร์ม แพลตฟอร์มอาจมีบทบาทในการเผยแพร่ข้อมูลเกี่ยวกับการเสนอขายและลักษณะการเสนอขายซึ่งดำเนินการโดยผู้เสนอขายหุ้นกู้ฯ เพื่อให้ผู้ลงทุนสามารถเข้าถึงข้อมูลดังกล่าวได้ แพลตฟอร์มจึงจัดให้มีมาตรฐานการพิจารณาโดยกำหนดให้ผู้ระดมทุนจะต้องยื่นเอกสารประกอบ นอกจากนี้ แพลตฟอร์มตัวกลางอาจเป็นช่องทางในการทำธุรกรรมการลงทุนหรือการสื่อสารระหว่างผู้ลงทุนกับผู้เสนอขายหุ้นกู้ฯ แต่การเปิดเผยข้อมูลและลักษณะการเสนอขายขึ้นอยู่กับนโยบายและวิธีการทำงานของแพลตฟอร์ม นักลงทุนจะต้องอ่านหนังสือข้อมูลเกี่ยวกับหุ้นกู้คราวด์ฟันดิง (Debenture Fact Sheet) ก่อนตัดสินใจลงทุนทุกครั้ง

การลงทุนในหุ้นกู้คราวด์ฟันดิงมีความเสี่ยงในเรื่องของเงินต้นหรือไม่

การลงทุนในหุ้นกู้คราวด์ฟันดิงเป็นการลงทุนที่ผู้ลงทุนต้องรับความเสี่ยงเองโดยตรง ผู้ลงทุนจึงต้องทำความเข้าใจความเสี่ยงที่เกี่ยวข้อง ซึ่งหมายรวมถึง (ก) ความเสี่ยงด้านสภาพคล่องของหุ้นกู้คราวด์ฟันดิง และ (ข) ความเสี่ยงในการสูญเสียเงินต้นจากการลงทุน เนื่องจาก หุ้นกู้คราวด์ฟันดิงเป็นการลงทุนที่ไม่ได้รับประกันความเสี่ยงและอาจมีสภาพคล่องน้อยเนื่องจากช่องทางในการเปลี่ยนมืออาจมีจำกัด ซึ่งผู้ลงทุนอาจจะสูญเสียเงินลงทุนบางส่วนหรือทั้งหมด ดังนั้น ผู้ลงทุนจึงจำเป็นต้องศึกษาข้อมูลและรายละเอียดเกี่ยวกับหุ้นกู้คราวด์ฟันดิงที่ตนจะจองซื้อ โดยเฉพาะข้อมูลเกี่ยวกับความเสี่ยงให้ชัดเจน ก่อนตัดสินใจลงทุนทุกครั้ง

ความเสี่ยงของผู้เสนอขายหุ้นกู้คราวด์ฟันดิงในการประกอบธุรกิจ

ผู้ออกหุ้นกู้คราวด์ฟันดิง คือ กลุ่ม SMEs ที่มีศักยภาพในการเติบโต และต้องการระดมทุนเพื่อใช้ในการหมุนเวียนธุรกิจ หากเปรียบกับธุรกิจขนาดใหญ่ที่ระดมทุนในรูปแบบหุ้นกู้ที่วงเงินการออกหุ้นกู้ค่อนข้างสูง อาจจะมีวัตถุประสงค์ในการระดมทุนที่แตกต่างกัน ความเสี่ยงที่จะประกอบธุรกิจไม่สำเร็จจะสะท้อนตามศักยภาพธุรกิจของ SMEs และจุดประสงค์ในการเปิดระดมทุนคือใช้ในการหมุนเวียน จึงไม่ได้บ่งบอกว่าผู้ออกหุ้นกู้ฯ จะประสบความสำเร็จในการประกอบธุรกิจ

ถ้าผู้เสนอขายหุ้นกู้เปิดเผยข้อมูลอันเป็นเท็จ นักลงทุนเรียกร้องค่าเสียหายอะไรได้บ้าง?

หากผู้เสนอขายหุ้นกู้คราวด์ฟันดิงมีการเปิดเผยข้อมูลอันเป็นเท็จ นักลงทุนสามารถใช้สิทธิเรียกร้องค่าเสียหายตามหลักกฎหมายแพ่งและพาณิชย์ได้ ทั้งนี้ สำนักงานคณะกรรมการกำกับหลักทรัพย์และตลาดหลักทรัพย์ (ก.ล.ต.) จะเป็นผู้เรียกร้องค่าเสียหายตาม พ.ร.บ หลักทรัพย์และตลาดหลักทรัพย์ฯ โดยค่าเสียหายดังกล่าวจะเป็นค่าปรับซึ่งจะต้องส่งให้กระทรวงการคลัง ดังนั้น นักลุงทุนที่เสียหายจึงไม่สามารถรับค่าเสียหายที่เป็นค่าปรับได้

เมื่อลงทุนไปแล้วผู้ออกหุ้นกู้ผิดนิดชำระ จะมีกระบวนการอย่างไร

เมื่อหุ้นกู้คราวด์ฟันดิงมีการชำระล่าช้า จะเกิดอะไรขึ้นบ้าง

เมื่อสยามวาลิดัสได้รับข้อมูลที่หุ้นกู้จะมีการผิดนัดชำระหนี้ และ/หรือ หุ้นกู้ผิดนัดชำระหนี้เมื่อถึงวันที่ครบกำหนดระยะเวลา สยามวาลิดัสจะทำการแจ้งนักลงทุนทางอีเมลและช่องทางการติดต่อพิเศษสำหรับกรณีหุ้นกู้ผิดนัดชำระ เพื่อให้นักลงทุนทราบว่าหุ้นกู้ดังกล่าวจะเข้าสู่กระบวนการติดตามทวงถามหนี้ทันที

ทั้งนี้กรณีที่ผู้ขอระดมทุนแจ้งขอปรับโครงสร้างหนี้หรือเลื่อนระยะเวลาการชำระเงิน สยามวาลิดัสจะดำเนินการแจ้งนักลงทุนเพื่อนัดหมายประชุมผู้ถือหุ้นกู้ต่อไป หากไม่สามารถติดตามทวงถามหนี้ได้และสิ้นสุดกระบวนการติดตามหนี้แล้ว นักลงทุนจะต้องเสียเงินต้นที่ลงทุนในหุ้นกู้คราวด์ฟันดิงนั้นไป

ทางเลือกของนักลงทุน เมื่อหุ้นกู้มีการผิดนัดชำระ

การบริหารจัดการหนี้เสียทั้งหมด 4 ทางเลือก ดังนี้

1. การบริหารจัดการหนี้ด้วยตนเอง กรณีก่อนการตกลงปรับโครงสร้างหนี้ หากนักลงทุนรายใดต้องการบริหารจัดการหนี้ภายใต้หุ้นกู้คราวด์ฟันดิงของตนเองด้วยตนเองแยกต่างหาก นักลงทุนซึ่งเป็นผู้ถือหุ้นกู้คราวด์ฟันดิงดังกล่าวสามารถแสดงความจำนงด้วยการส่งหนังสือแจ้งมายังสยามวาลิดัสโดยตรงได้ว่า นักลงทุนต้องการบริหารจัดการหนี้หุ้นกู้คราวด์ฟันดิงดังกล่าวด้วยตนเอง ซึ่งในกรณีนี้หนี้ของนักลงทุนนั้นจะไม่ถูกรวมเข้าไปในมติที่ประชุมผู้ถือหุ้นกู้ที่จะมีการเสนอเพื่อการตกลงปรับโครงสร้างหนี้

2. การตกลงปรับโครงสร้างหนี้ หากบริษัทมีความสามารถและความตั้งใจในการชำระคืน ซึ่งกรณีการปรับโครงสร้างหนี้นี้จะดำเนินการโดยผ่านมติที่ประชุมผู้ถือหุ้นกู้คราวด์ฟันดิงของผู้ถือหุ้นกู้ฯ ที่ถือหุ้นกู้ฯ เกิน 25% และจะมีการลงนามในสัญญารับสภาพหนี้ร่วมกันระหว่างผู้ถือหุ้นกู้ฯ ทุกท่านและบริษัทผู้ออกและเสนอขายหุ้นกู้คราวด์ฟันดิง

กรณีที่ผู้ถือหุ้นกู้คราวด์ฟันดิงตกลงลงนามผูกพันตามสัญญารับสภาพหนี้ร่วมกับผู้ถือหุ้นกู้ฯ รายอื่นทั้งหมดแล้ว ผู้ถือหุ้นกู้คราวด์ฟันดิงรายใดรายหนึ่งจะไม่สามารถดำเนินการตกลงเจรจาแยกต่างหากกับบริษัทผู้ออกและเสนอขายหุ้นกู้คราวด์ฟันดิงได้อีก เนื่องจากการเจรจาหรือแก้ไขเปลี่ยนแปลงระหว่างผู้ถือหุ้นกู้คราวด์ฟันดิงรายดังกล่าวกับบริษัทผู้ออกหุ้นกู้คราวด์ฟันดิงย่อมจะสร้างผลกระทบต่อสิทธิของผู้ถือหุ้นกู้คราวด์ฟันดิงที่เป็นเจ้าหนี้รายอื่น หากต้องการแก้ไขเปลี่ยนแปลงเงื่อนไขในสัญญารับสภาพหนี้ต้องเป็นการแก้ไขด้วยการแจ้งผ่านมติที่ประชุมผู้ถือหุ้นกู้คราวด์ฟันดิงร่วมกันใหม่ เพื่อแก้ไขสัญญารับสภาพหนี้ดังกล่าวอีกครั้งเท่านั้น

3. การฟ้องร้องดำเนินคดี หากเป็นกรณีที่ (ก) ไม่สามารถติดต่อผู้ออกหุ้นกู้คราวด์ฟันดิงได้ หรือ (ข) ผู้ออกหุ้นกู้คราวด์ฟันดิงไม่มีความสามารถหรือความตั้งใจจะชำระคืนหนี้สิน หรือ (ค) ผู้ออกหุ้นกู้คราวด์ฟันดิงผิดนัดตามสัญญารับสภาพหนี้อีกครั้ง สยามวาลิดัสจะเสนอให้มีการดำเนินกระบวนการฟ้องร้องคดีต่อไป โดยการว่าจ้างทนาย

4. การขายหนี้เสียให้แก่บริษัทบริหารจัดการหนี้สิน สำหรับทางเลือกใหม่ตามที่นักลงทุนเสนอมานี้

สำหรับการเลือกทางเลือกที่ 4 นี้เป็นสิทธิของผู้ถือหุ้นกู้คราวด์ฟันดิงแต่ละรายโดยตรง แยกต่างหากจากกัน ที่จะตัดสินใจขายหุ้นกู้คราวด์ฟันดิงที่ผิดนัดดังกล่าวหรือไม่ โดยราคาซื้อขายจะขึ้นกับบริษัทจัดการหนี้ที่จะเสนอมาและส่วนใหญ่บริษัทเหล่านี้จะทำการเสนอราคาเป็นรอบๆ โดย1 ปีจะมีการเสนอราคาประมาณ 1-2 รอบ

การสนับสนุนด้านเทคนิค

ลืมรหัสผ่าน ต้องทำอย่างไร

กรณีที่ท่านลืมรหัสผ่าน ท่านสามารถดำเนินการได้ดังนี้

1.กด “ลืมรหัสผ่าน”

2.กรอกที่อยู่อีเมลที่ใช้ลงทะเบียนกับสยามวาลิดัส

3.โปรดตรวจสอบกล่องจดหมายในอีเมลของท่านและปฏิบัติตามคำแนะนำเพื่อรีเซ็ตรหัสผ่าน

บัญชีโดนล็อกต้องทำอย่างไร

กรณีที่ท่านไม่สามารถเข้าใช้งานบัญชีได้เนื่องจากถูกระงับบัญชี

กรุณาติดต่อ Siam Validus Call center โทร +(66) 2-026-6574 หรือ

Email มาที่ IR@siamvalidus.co.th ด้วยอีเมลที่ลงทะเบียนไว้กับทางสยามวาลิดัส

ต้องการเปลี่ยนแปลงข้อมูลส่วนตัว ต้องทำอย่างไร

ท่านสามารถแจ้งเปลี่ยนแปลงข้อมูลส่วนตัวได้โดยดำเนินการดังนี้

1. ดาวน์โหลด “แบบคำขอเปลี่ยนแปลงข้อมูล”

2. กรอกรายละเอียด “แบบคำขอเปลี่ยนแปลงข้อมูล” ตามข้อมูลที่ท่านต้องการเปลี่ยนแปลง และลงนามในเอกสารให้สมบูรณ์

3. เข้าสู่ระบบ และดำเนินการอัปโหลด “แบบคำขอเปลี่ยนแปลงข้อมูล” บนเว็บไซต์ของสยามวาลิดัส

4. เมื่ออัปโหลดเอกสารแบบคำขอเปลี่ยนแปลงข้อมูลบนเว็บไซต์สำเร็จ ท่านจะต้องแจ้งขอเปลี่ยนข้อมูลมาที่อีเมล operation@siamvalidus.co.th เพื่อให้เจ้าหน้าที่ดำเนินการในลำดับต่อไป

5. เจ้าหน้าที่จะทำการตรวจสอบเอกสารและดำเนินการเปลี่ยนแปลงข้อมูล มีระยะเวลาดำเนินการ 1 วันทำการกรณีที่ท่านเปลี่ยนแปลง ชื่อ – นามสกุล จะต้องแนบเอกสารประกอบการเปลี่ยนแปลงดังนี้

1. ภาพถ่ายบัตรประชาชนใบปัจจุบันที่ยังไม่หมดอายุ หน้า – หลังที่ชัดเจน ( กรณีใช้สำเนาบัตรประชาชน กรุณาลงลายมือชื่อรับรองสำเนาถูกต้องโดยไม่บดบังข้อมูลบนเอกสาร)

2. โปรดแนบเอกสารแสดงการเปลี่ยนชื่อ – นามสกุลหรือทะเบียนสมรสกรณีที่ท่านเปลี่ยนแปลงข้อมูลบัญชีธนาคารสำหรับรับเงินต้นและผลตอบแทนคืน จะต้องแนบเอกสารประกอบการเปลี่ยนแปลงดังนี้

1. ภาพถ่ายสมุดบัญชีเงินฝากหน้าแรกของบัญชีใหม่ที่ท่านต้องการเปลี่ยนแปลงหรือติดต่อ Siam Validus Call center โทร +(66) 2-026-6574 เจ้าหน้าที่จะให้คำแนะนำกับท่านโดยตรง

สยามวาลิดัสมีนโยบายคุ้มครองข้อมูลส่วนบุคคลอย่างไร

ความเป็นส่วนตัวและข้อมูลส่วนบุคคลของท่านมีความสำคัญต่อสยามวาลิดัส สยามวาลิดัสให้ความสำคัญในเรื่องนี้เพื่อให้ท่านแน่ใจว่าแพลตฟอร์มของสยามวาลิดัสมีความปลอดภัยสูงสุด และเป็นไปตามพระราชบัญญัติคุ้มครองข้อมูลส่วนบุคคล พ.ศ. 2562 ท่านสามารถอ่านรายละเอียดเกี่ยวกับ นโยบายความเป็นส่วนตัว ได้ ที่นี่

แจ้งปัญหาการใช้งาน

กรณีที่ท่านพบปัญหาการใช้งานสามารถติดต่อสยามวาลิดัสได้ด้วยช่องทางต่อไปนี้

1. Siam Validus Call center โทร +(66) 2-026-6574

2. อีเมล

ด้านการลงทุน Email: IR@siamvalidus.co.th

ด้านการระดมทุน Email: SME@siamvalidus.co.th

ด้านพันธมิตรธุรกิจ Email: INFO@siamvalidus.co.th

3. Line Official ID : @Siamvalidus

การร่วมทุนระหว่าง เอสซีจี ดิสทริบิวชั่น และ วาลิดัส บริษัทฟินเทคชั้นนำในภูมิภาคอาเซียน

สยาม วาลิดัส เป็นบริษัทในกลุ่มของ วาลิดัส ซึ่งเป็นกลุ่มบริษัทฟินเทคชั้นนำในภูมิภาคอาเซียน และเป็นพันธมิตรกับบริษัท เอสซีจี ดิสทริบิวชั่น จำกัด ซึ่งเป็นบริษัทชั้นนำด้านธุรกิจจัดจำหน่ายในประเทศไทยและภูมิภาคอาเซียน

เราคือหนึ่งในแพลตฟอร์มระดมทุนให้ธุรกิจ SMEs ที่ใหญ่ที่สุดในภูมิภาค โดยมีเป้าหมายเพื่อลดช่องว่างด้านเงินทุนในกับ SMEs ในภูมิภาค ซึ่งบริษัทได้นำเทคโนโลยี Artificial Intelligence (AI) มาใช้ในการช่ายระดมทุนให้กับ SMEs

นอกจากนี้ สยาม วาลิดัสยังเป็นบริษัทจากต่างชาติรายแรกที่ได้รับความเห็นชอบจากสำนักงานคณะกรรมการกำกับหลักทรัพย์และตลาดหลักทรัพย์ (ก.ล.ต.) ในการให้บริการระบบคราวด์ฟันดิง สำหรับการระดมทุนในรูปแบบ หุ้นกู้ เพื่อธุรกิจ SMEs ในประเทศไทย และมีการจับมือร่วมกับบริษัทชั้นนำอีกหลายแห่งเพื่อเข้าถึงกลุ่ม SMEs ในวงที่กว้างขึ้น

วาลิดัส ได้รับการไว้วางใจและสนับสนุนจาก Venture Capital ชั้นนำ